- Posted on

- Comments 0

Planning Ahead is an Act of Love

By Erin McCune . February 14th, 2021

In honor of Valentine’s day, Easeenet’s Founder & CEO Erin McCune chatted with Black Dress Consultants’ Founder, Rachel Donnelly, about how death positivity can truly be an act of love.

Catch the replay here!

They agreed that it can seem a bit strange that thinking about and planning ahead for your death can be a gift of love to your family, and yet it truly is. They also talked about how death positivity can help you live your life to its fullest, and reduce anxiety about mortality.

What is Death Positivity?

The term was first coined in 2013 by Caitlin Doughty, founder of Order of the Good Death, but it has since become a worldwide movement. Robert Neimeyer, PhD, says that “it’s a way of moving toward neutral acceptance of death and embracing values which make us more conscious of our day-to-day living.” By accepting death as a natural part of life, and talking about our end-of-life wishes, death positivity allows us to replace fear with empowerment.

Why is End-of-Life Planning so important?

On average, it takes 570 hours to settle an estate when someone passes, but the amount of time and stress required can vary wildly based on how much end-of-life planning has been completed. While no one really wants to think about dying, getting organized with your paperwork and being candid with your loved ones and next of kin about what you want can save them countless hours and untold amounts of stress. End-of-life planning gives you peace of mind and allows you to live your life more fully, while giving your family a tremendous gift in the future.

“The last thing your loved ones need is to deal with more stress in their most vulnerable moments,” Erin says. “There are already plenty of decisions to be made during the days and weeks after someone passes away, and people really do want to honor their loved ones’ wishes– but they can’t do that if they don’t know what those are.”

What are the first steps I should take to plan?

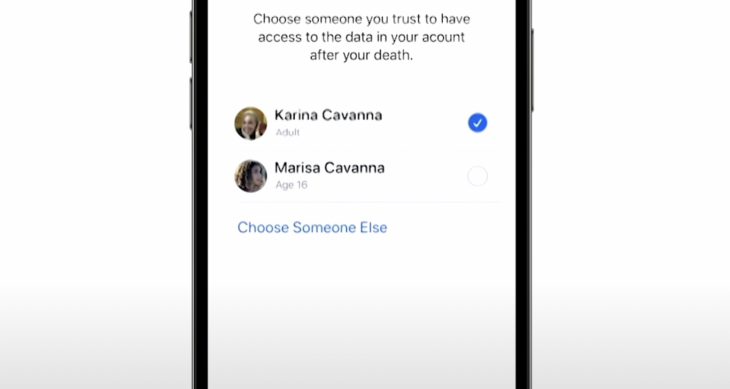

Rachel spends her life helping people make their end-of-life plans, and helping families after a loved one has passed away. She says that there are a few levels of planning you can do to help your family, but “Level 1 is making sure that your financial and legal documents are in order, like your will, your durable power of attorney, and your advance directive (or your state’s equivalent).” You’ll want to make sure you’ve identified both an executor and a digital executor, someone who can stand in your shoes online. Once you’ve completed Level 1, move on to Level 2, where you protect your family legacy and digital estate. Given the amount of family pictures, videos, and memories online today, “make sure your family knows how to access your online accounts,” Rachel recommends. “Whether you use Easeenet or another tool, ensure your loved ones won’t get locked out of your family legacy.”

This all sounds like a lot of work- but is it?

Ben Franklin once said, “every minute spent organizing, an hour is earned.” While it can take some time and money to ensure that your estate is in order, the time you spend now is a gift to your family, that will come back to them multiplied many times. There are also lots of tools and people to help. You can get your digital estate in order with Easeenet, and it only takes about 5 minutes to get started. Rachel at Black Dress Consultants can help you navigate all the decisions and pieces you need to ensure that your family is left with a clean, organized plan. Your loved ones will be able to access what they need, and feel confident and connected to you as they’re able to execute on your wishes, knowing that they’re honoring your life.

Now Through March 10th Grab the FREE ebook: “The 25 Documents You Need Before You Die” from Black Dress Consultants AND receive 3 FREE months of Easeenet!

https://go.easeenet.com/death-positive

Want all the latest news in retirement and end of life planning, computer security, Digital Estate organization, tech news, money management and more? Stay in touch with us! Subscribe to our newsletter.