- Posted on

- Comments 0

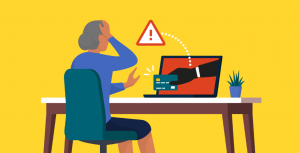

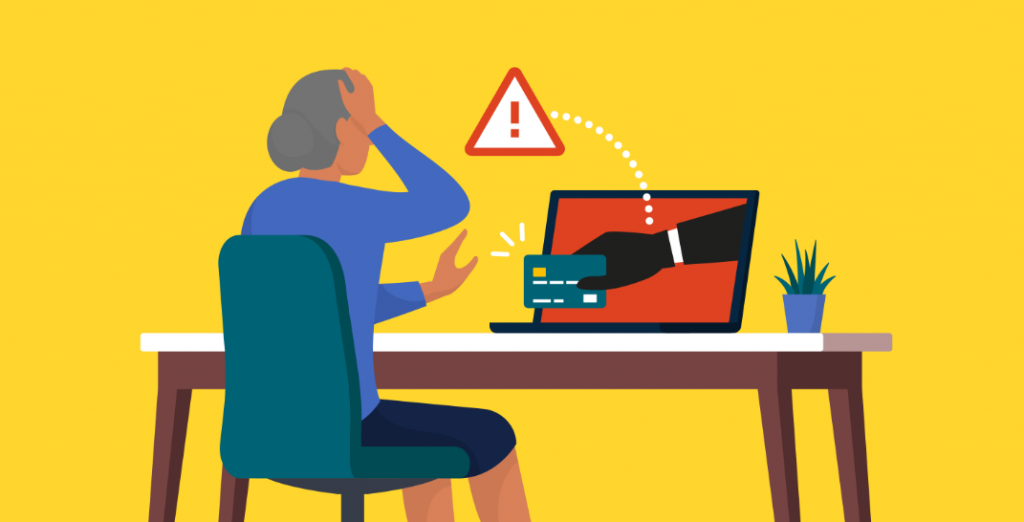

Elder Fraud: A Complete guide to learning the signs and preventing elder scams

By Rachel Sommer . March 11, 2021

Protect those you love by learning the signs of elder fraud and the steps to prevention.

Most of our beloved elders still see themselves at a younger age and would not believe they could be susceptible to fraud, but because of the pandemic seniors are more at risk than ever. It’s easy to see why criminals target the elderly, they may have a regular source of income such as Social Security or a pension or multiple significant assets saved. They also may be especially vulnerable due to health problems and isolation.

“I’ve interviewed people who have lost their life savings and now don’t have any money to even buy groceries…I’ve seen them SOB.”

-Dale Sekovich, Federal Trade Commission investigator.

Who is David Diamond?

David Diamond is the actual name of one of the most successful unscrupulous salesmen in one of the longest running telemarketing scams in Los Angeles history in the 1980s. His story was featured on This American Life.

A con man who made millions fooling people over the phone with fake investment schemes; He targeted retired seniors with large nest eggs to pitch faulty investments. He personally conned his victims out of 6 million dollars.

“Every time I hear these pitches I’m outraged because I am the person that spoke to people who really did send David Diamond tens of thousands of dollars that consisted of their life savings and now don’t have any money to even buy groceries…I’ve seen them SOB….It makes me very angry.” -Dale Sekovich, Federal Trade Commission investigator.

As Dale explains he was “Making money hand over fist and living high on the hog,” while elders have little to no recourse after losing their life savings. After promising vulnerable seniors millions in earnings, no one made a dime except for the con artists running these operations. This grift has been around for a while but the number of these cases has significantly increased due to more seniors spending time online and the isolation from the pandemic.

Isolated seniors are increasingly susceptible to elder abuse and fraudulent scams.

Watch out for these common stranger scams

Government scams (IRS/Medicare) — Scammers pose as government officials requiring their victims to wire cash or use prepaid debit or gift cards to pay a bogus tax bill. Or they may provide sham Medicare services at makeshift mobile clinics in order to bill the insurance and pocket the money. Medicare scams often follow the latest trends in medical research, such as genetic testing fraud and COVID-19 vaccines fraud.

Romance scams — Internet dating is at an all time high making way for con artists to find their next victim. Romance scammers create elaborate fake profiles on dating websites and social media, and exploit seniors’ loneliness for money. In some cases, romance scammers may (or pretend to) be overseas, and request money to pay for visas, medical emergencies, and travel expenses. They can often drag on for a long time, so romance scammers can get a lot of money from a senior—the FTC found that in 2019 alone, seniors lost nearly $84 million to romance scams.

Sweepstakes & Lottery scams — Under the guise of a telemarketing call to notify the winner of a lottery or sweepstakes, seniors will be sent a check that they can deposit in their bank account, knowing that while it shows up in their account immediately, it will take a few days before the (fake) check is rejected. During that time, the criminals will quickly collect money for supposed fees or taxes on the prize, which they pocket while the victim has the “prize money” removed from his or her account as soon as the check bounces.

Charity Scam — Charity scams prey on seniors’ goodwill to pocket money they claim they’re raising for a good cause. Some scammers may use a name similar to a legitimate charity. They often capitalize on current events, such as natural disasters, and may set up a fundraising page on a crowdsourcing site, which don’t always have to means to investigate fraud. Charity scammers may insist you donate immediately, sometimes with a payment method that should be a red flag — e.g., gift cards or money transfer.

“Friends” with ulterior motives: Elders who live alone may be especially at risk to con artists posing as friends can cost you dearly. Someone who lives nearby may offer to assist with chores and errands, or even to serve as a home health aide—and soon may begin “helping” with financial transactions, gaining access to accounts.

Found Pet Scam — Your pet is MIA, so you post flyers around the neighborhood and maybe even run ads on Craigslist or post to Facebook to help you locate your lost friend. A person contacts you saying he knows who has stolen your pet and is willing to help you get the animal back — for a fee or even worse says that the pet is hurt and will need money to pay for the vet costs.

Phishing Email — Hackers can go to painstaking lengths to ensure that their fraudulent email imitates the real thing. Sometimes an email will arrive in your inbox that looks very authentic and matches the style used by your bank or other business almost exactly. Do NOT click on any links within an email, unless you’re expecting that email. Navigate directly to the site and log in if you think the message is legitimate. Also look closely at the sender of emails, and any typos in an email, as they can be indicators of phishing schemes. Keep an eye out for emails requesting you to confirm personal information that you would never usually provide, such as banking details or your Social Security number. Do not reply or click any links and if you think there’s a possibility that the email is genuine, you should search online and contact the organization directly – do not use any communication method provided in the email. Finally, NEVER EVER give out a two factor authentication code from a website to ANYONE, even if they say they’re with that company.

Sometimes the abusers are known

68% of older investors believe that a stranger would be the most likely perpetrator of financial exploitation against them.1 But the reality is very different — According to National Adult Protective Services Association, it is estimated that in up to 90% of elder financial exploitation cases, the abuse is a family member or trusted person.

Typical types of financial abuse include:

• Using ATM cards and stealing checks to withdraw monies from the victim’s accounts

• In-home care providers charging for services; keeping change from errands, paying bills which don’t belong to the vulnerable adult, asking the vulnerable adult to sign falsified time sheets, spending their work time on the phone and not doing what they are paid to do

Who can I trust?

Scammers will try to associate with legitimate businesses to gain trust and appear reputable to the untrained eye. So how do you know who you can trust? Look out for anything that feels too good to be true, because it usually is. Also be on the lookout for anyone who tries to pressure you or pushes a limited time offer or an all or nothing attitude in regards to your money. A conman’s greatest manipulation tactic is emotion.

An estimated 2.9 billion 36.5 billion dollars is lost every year to financial exploitation of older adults.

Consumer Financial Protection Bureau. Suspicious Activity Report of Elder Financial Exploitation: Issues and Trends Report, February 2019

What are the signs?

These skilled grifters play on the vulnerabilities of the elderly and seek out those with few family members or try to isolate their target from their loved ones. Since money is already such a personal topic that many don’t discuss; it can be even harder to detect when your loved one has become the victim of one of these scams.

An Issues and Trends Report from February 2019 by Consumer Financial Protection Bureau found that an estimated 2.9 billion 36.5 billion dollars is lost every year to financial exploitation of older adults. A group known as solo agers — people who are living alone in their later years, or who do not have trusted individuals nearby who can help look out for their best interests are especially vulnerable to these scams.

Without the benefit of a second pair of eyes and ears these elders may take risks they shouldn’t. Due to increased isolation from the pandemic elders are more at risk than ever. Additionally, researchers at the University of Iowa say people who feel lonely are more likely to engage in impulsive behaviors, such as unplanned spending or over-eating. According to the National Center of Elder Abuse, the primary contributing factor in elder financial exploitation is social isolation. These reasons are why its more important than ever to stay in touch and check in on the elders in our life.

Try to start having open conversations about finances and look out for the following signs:

- Secrecy around finances

- Unexplained transfers

- Reluctance to discuss financial matters that were previously normal

- Sudden, atypical, or unexplained withdrawals, liquidations, wire transfers, or payments to an unusual recipient

- Unpaid bills; confusion about accounts, funds, and transactions

- Abrupt or unexplained changes in legal documents

- Excessive interest in finances of a senior by family members or others

- Signatures that seem suspicious or forged

Be aware of physical, social, and behavioral changes

• Relationships with new best friends and new love interests

• Isolation either deliberately or as a result of life changes

• Decline in mental capabilities, onset or worsening of illnesses

• Changes in behavior, including fear, depression, and withdrawal

• Disheveled appearance, forgetfulness, and disruptions to normal routine

• Missing possessions from the home or residence

Appointing a financial advisor or ensuring there is someone they can trust to talk to about financial matters, is also key.

If you are able it is a great idea to walk your family member through basic processes on their phone or computer and have them take notes. It may also be a good idea to enroll your loved one in a computer or phone class for seniors. There are plenty of online options and many community colleges offer these courses free of charge!

• Change account numbers, phone numbers, credit/debit card numbers,

and passwords if your information is compromised.

• Review credit reports, account statements, and bills carefully for

any unusual activity or charges.

• Send duplicate statements to a trusted person for review.

Steps to avoid scams

- Change account numbers, phone numbers, credit/debit card numbers, and passwords if your information is compromised.

- Review credit reports, account statements, and bills carefully for any unusual activity or charges.

- Send duplicate statements to a trusted person or advisor for review.

- Set up a password manager, like Easeenet, that will detect fraudulent websites

- Do not allow yourself to be pressured into making purchases, signing contracts, or committing funds. These decisions are yours and yours alone.

- Ask your medical providers what they will charge and what you will be expected to pay out-of-pocket.

- Don’t buy from an unfamiliar company. You can learn more about reputable companies from the Better Business Bureau.

- Make sure you understand all contract cancellation and refund terms.

- Be an informed consumer. Take the time to call and shop around before making a purchase. Take a friend with you who may offer some perspective to help you make difficult decisions.

Our Commitment to you

Easeenet helps you keep you safe online! If you visit a fake website, the Easeenet password manager will not recognize it and will not fill in credentials on a scam site. Easeenet also has military grade encryption to give you top notch security and peace of mind.

Try Easeenet free for 14 days!