- Posted on

- Comments 0

7 Digital Estate Items You have to handle today

By Erin McCune . March 15, 2021

It is vital to be as specific and detailed as possible while we prepare for the unthinkable yet the inevitable. To get started, here are 7 Digital Estate items you can take care of in less than an hour!

1. Designate a digital executor (and leave instructions!)

You may be thinking what is a digital executor? Well, It is someone you assign in your will to handle everything regarding your digital estate when you pass away. This person handles everything from cancelling automated payments to closing social media accounts. Leaving detailed instructions for what accounts you want to deleted to who gains access to your photos and documents becomes a simple process with Easeenet’s Legacy Worksheet and Legacy Contact system.

2. Set up your Google Inactive Account Manager

An Inactive Account Manager is a way for users to share parts of their account data or notify someone if they’ve been inactive for between three months and 18 months. Google monitors your last sign-ins, your recent activity in My Activity, usage of Gmail (e.g., the Gmail app on your phone), and Android check-ins and determines when you have been inactive. Deleting your Google Account will affect all products associated with that account (e.g., Blogger, AdSense, Gmail), and will affect each product differently. Your designated contact will only receive notification once your account has been inactive for the specified amount of time.

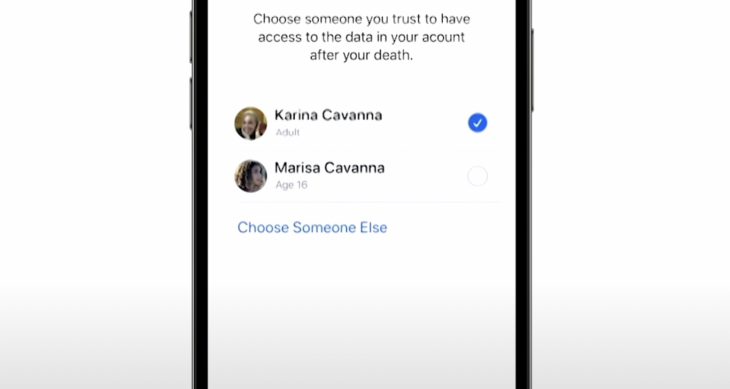

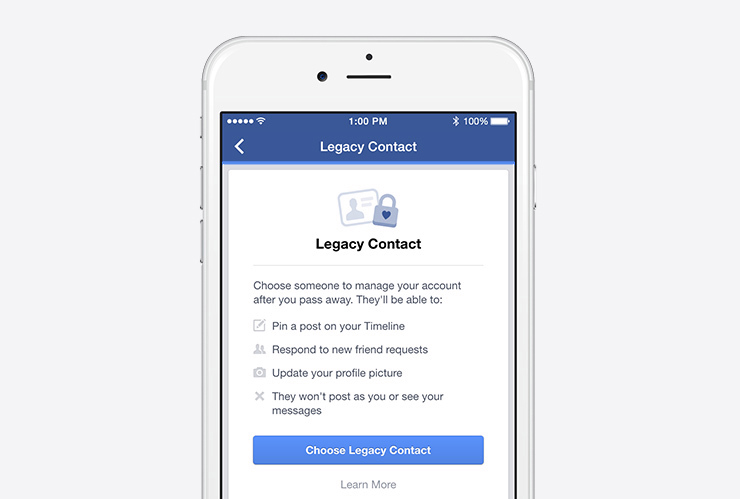

3. Assign a Facebook Legacy Contact

The social media site with the most end-of-life preparation options today is Facebook, which allows you to designate a legacy contact. When Facebook becomes aware that you’ve passed away, your account will automatically become Memorialized, which changes your name to reflect that your page is “remembering” you, and no one can log in directly to your account. Your named legacy contact will be able to make certain changes:

- Alert Facebook that you have passed away

- Pin a tribute post to the profile

- Change the profile photo and cover photo

- Respond to new friend requests (they cannot remove friends)

- Untag photos of you

- Decide who can see and post tributes

How do you designate a Facebook legacy contact?

Visit Settings & Privacy > Settings > Memorialization Settings > (Choose your friend) > Add > Send (to notify them)

You may not want a Legacy Contact and that’s fine too! You may decide for your account to be deleted after your death – this is also an option in the Memorialization settings of your account.

4. Make sure your digital executor knows your Usernames/ passwords

Email, iCloud, Twitter, Netflix – think of all things that you need a username and Password for. You may be thinking, well my spouse and I share everything I can just log into their accounts on our computer…well this becomes messy when you factor in Terms of Service. While violating Terms of Service is not considered a crime, it is good practice to play by the book in this case; and if there is an account you don’t have the password for you could wind up in a huge legal battle with a tech company. Like this story of a man simply trying to access the photos of his late wife.

Make sure that your Digital Executor has the information for these accounts to gain access after death. Using a password manager like Easeenet makes this a painless process. With our combined browser extension tool and legacy contact system you really can set it and forget it!

5. Make sure your Digital Executor knows your Phone password

For two factor authentication alone, this one is huge! But some apps are only available on your phone, or are easiest to access there and we want to make this process as streamlined as possible for our next of kin. Have your phone password in an accessible location for your digital executor, Easeenet has a designated spot for this at the top of the Legacy Worksheet for fast and easy access.

6. Identify which accounts are on Paperless Billing and Autopay

Make sure you’ve identified which accounts are on paperless billing and autopay. Otherwise, your family may have the electricity turned off without ever receiving a bill, or your estate may continue paying your car insurance for months before anyone realizes. With Easeenet you can set up an entire section dedicated to bills for easy access for your next of kin.

Nearly 90% of crypto owners are worried about what will happen to their crypto after they pass away.

2020 study by the Cremation Institute

7. Make a plan for your digital valuables

Digital valuables tend to get put on the backburner when planning our estates but these assets can be passed on to our next of kin just like physical assets. Take Bitcoin for example, According to a 2020 study by the Cremation Institute, nearly 90% of crypto owners are worried about what will happen to their crypto after they pass away. As a distributed network, Bitcoin has no authority to control user funds, so no one but the owners themselves can control their assets. As a result, millions of dollars in crypto is being lost each year through the deaths of its owners. Bitcoin and other crypto currency can certainly be bequeathed to the next generation it just takes a little more research and preparation. In the eyes of the IRS cryptocurrencies aren’t actual currencies. Rather, they’re treated and taxed as goods. It is of utmost importance to designate a beneficiary in your online account, this would take precedence over account instructions listed in your will, trust or power of attorney documents.

Another digital asset commonly forgot about are airline miles. However, almost every single loyalty program’s terms and conditions states that points, miles, and loyalty currency are not actually your property. However, most programs (but not all) make it fairly straightforward to transfer points and miles upon death. You will need to check the terms and conditions of your individual loyalty program and find out their policy, The Points Guy has made a very helpful resource for doing just that. If you have yet to sign up for a loyalty program this policy may be an important factor to consider when making your selection.

Does this sound like a lot to manage? Let us make it Easy. Set up your Digital Estate today with Easeenet’s free trial!