What is a Digital Estate? (Psst: you already have one)

By Rachel Sommer . January 14th, 2021 | Updated May 9, 2022

Recent legislation has changed the way digital assets are handled with regard to estate planning, but that leaves us with the question of what exactly is a digital estate?

Every day, more and more of our time is spent online. Globally, over 4.57 billion people use the internet. That’s 59% of the world’s population. Of those, 3.9 billion utilize email. Whether they realize it or not, each and every one of those people has already created a digital estate. But your digital estate is much more than just email. With social media, electronic banking, documents saved to the cloud, etc., our digital estates grow more complex by the day. The average American consumer has more than 90 accounts with usernames and passwords. Every single one of those is part of your digital estate.

What is Your Digital Estate?

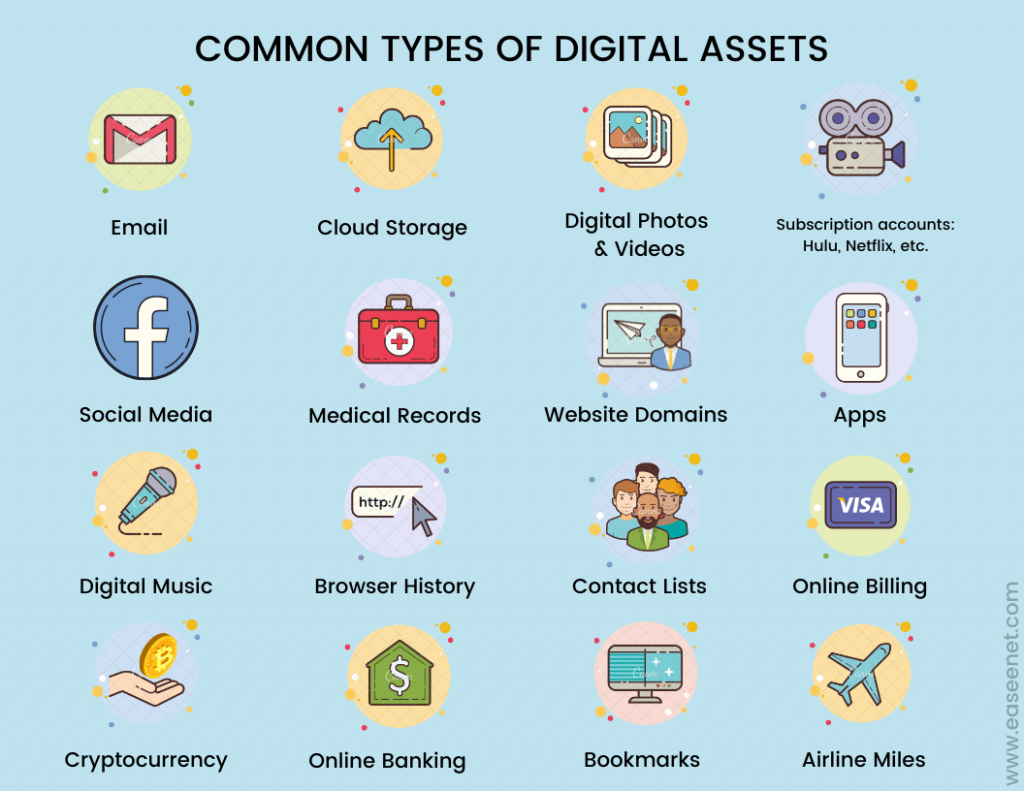

Your digital estate is made up of:

- Online Accounts

- Social media profiles & posts

- Messages and saved posts on social media

- Blogs

- Health Records

- Paperless billing statements (like your bank statement)

- Cloud Storage

- Web Browser Bookmarks

- Photos & Videos

- Virtual currency (like Bitcoin)

- Credit Card Points

- Airline Miles

- Subscriptions

- and more!

A digital estate is more than just a person’s online presence. Also included in your digital estate are all of the technology devices you have, and all the data stored on them– your laptop, cell phone, hard drives (including external hard drives), tablets, etc.

Some pieces of your digital estate you might not even think about, but have value, include airline frequent flyer miles, reward points, and domain names. (Believe it or not, a man sold virtual property inside a video game for $635,000!) Even bills that you pay online are part of your digital estate.

Digital Estate Planning

So how do you go about capturing all of this information and ensuring that it can be passed on if something happens to you? Digital estate planning becomes very important, and there are a variety of tools that can help you.

Your first option is to translate digital assets back to tangible items that can be physically transferred. For example, in the case of music files, you can save them to a USB flash drive, external hard drive, or burn them to CDs. Your email records or other pertinent online data could be printed and saved to a physical storage device. Obviously this option poses a lot of security and practical issues. What if there is a fire? What if these items get lost or if your storage gets broken into (i.e. a safe.)? Also, while our technology increases at an ever-growing pace, it will become increasingly difficult to access more dated forms of storage like a CD.

Online tools, such as Easeenet, allow users to capture their online account usernames and passwords, transferring them seamlessly to a designated contact in the event something happens to you. This allows digital estate executors to access account information without having to spend hours on the phone trying to track down your login information.

Additionally, these tools can provide access to pertinent medical information, such as health records, medications, etc. in the event of a medical emergency. This becomes especially important for family and executors who aren’t close to the person geographically, and would not otherwise have immediate access to such information.

How to plan for your digital estate:

- Create an inventory of your digital assets, including account information with usernames and passwords

- Decide what you want to happen with these accounts

- Name a Digital Executor in your will and power of attorney

- Store updated information in a secure but accessible place, such as Easeenet

- Contact an Estate Planning Attorney to legalize your digital estate

Laws About Digital Estate Planning

New legislation, the Revised Uniform Fiduciary Access to Digital Assets Act, or “RUFADAA”, was passed in 2015 and extends the traditional power of an estate executor to manage tangible property to include management of digital assets. As of 2020, RUFADAA has been enacted in 45 states, all except California, Louisiana, Massachusetts, Oklahoma, and Washington DC. Basically, If you don’t write a will, the law writes one for you, including laws around your digital data. In order for this act to apply to your estate, the law requires that this access be explicitly granted to a Digital Executor by means of a will, trust, power of attorney, or other legal record.

Why Choose Easeenet?

Easeenet acts as your comprehensive Digital Estate Planning tool. We take care of everything from A-Z in regards to your digital footprint. In our secure servers, you can manage the entirety of your online accounts and keep them up-to-date in real time using our password manager. You maintain complete control over who gets access and when by assigning multiple Legacy Contacts. You have an easy worksheet to capture and preserve the critical life details that your family will need if anything happens. You can easily add notes to documents and websites, bookmark webpages, upload documents and media, and we even have a google search bar so you can make us your homepage for easy access! Activate your 14 day trial and start preserving your digital estate today.

Like this article? Keep up with the latest news by following us on Facebook!

One thought on “What is a Digital Estate? (Psst: you already have one)”