- Posted on

- Comments 0

What is RUFADAA and why should you care?

By Rachel Sommer . April 19, 2021

Many things that were known to us primarily as physical objects less than a generation ago are now stored online. What does this mean for estate planning?

RUFADAA (“roo-fa-dah.”), or the Revised Uniform Fiduciary Access to Digital Assets Act, is federal legislation passed in 2015, that allows you to designate a digital executor to stand in your place online when you become incapacitated.

Instead of shoeboxes full of polaroids we now have clouds of pictures, letters have become emails and even our currency is mostly virtual these days.

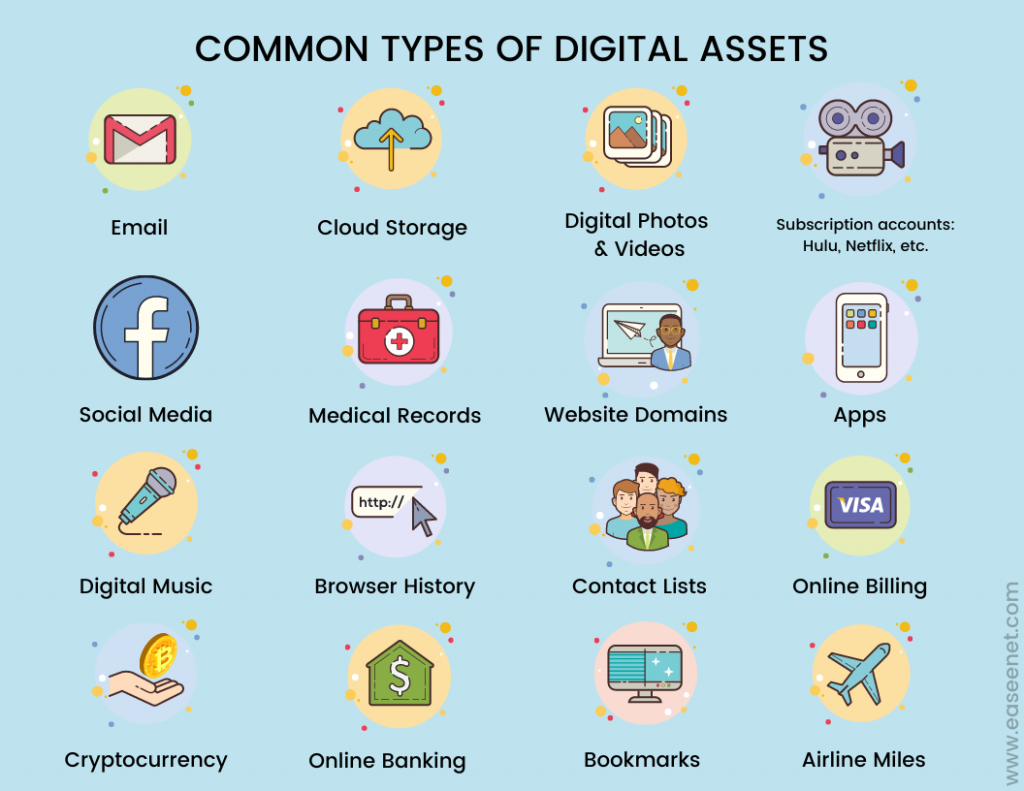

If you have any online accounts, files, or photos, you have digital assets, which also means you have a Digital Estate. The average American has over 200 online accounts and with new technology, that number is only growing. The Uniform Law Commission created the widely supported Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) in 2015 and as of 2020, RUFADAA has been enacted in 45 states, all except California, Louisiana, Massachusetts, Oklahoma, and Washington DC.

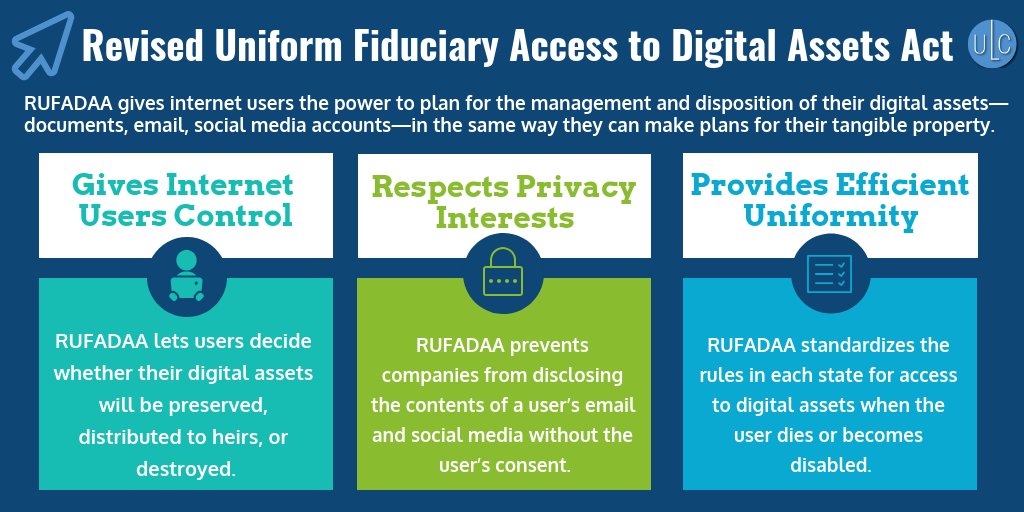

The purpose of RUFADAA is straightforward and well-intended. As its drafters at the Uniform Law Commission (ULC) put it, the act “gives Internet users the power to plan for the management and disposition of their digital assets similarly as they can make plans for their tangible property.”¹

How is RUFADAA changing digital estate planning?

Our fast-advancing technology is causing many people to adapt, including estate planners and your next of kin. Instead of shoeboxes full of polaroids we now have clouds of pictures, letters have become emails and even our currency is mostly virtual these days.

So what does this mean for estate planning? If digital assets were held in the physical possession of a deceased person—on a computer, flash drive, or other devices—they could be distributed in much the same manner as tangible property. More often than not, digital assets are kept on the servers of a third party such as Facebook, Google, or online cloud storage requiring login information for access.

While it may seem like the simple solution to keep a list of account credentials “in a safe place” for our next of kin to use “just in case”, the fact that they might have the information to access the accounts doesn’t necessarily mean that they have the legal authority to do so, especially when a website’s Terms of Service do not permit a transfer of ownership. In fact, your next of kin could be locked out of your accounts and potentially find themselves in a legal battle with a large tech corporation.

It’s easy to think of our emails and online storage as belonging to us but that is not actually the case. Every time a user signs up for any kind of online account they must agree to terms of service, which includes what happens to their data and contents of their accounts after they pass away. The original user does not own the account or the contents in it, they simply own the rights to use the online account.

Under RUFADAA, Tech companies, which maintain user accounts containing digital assets and include the likes of Apple and Google, are known as “custodians.” RUFADAA protects its users’ privacy and limits a fiduciary’s access to certain digital content unless the decedent has affirmatively authorized it in their will. This act extends the traditional power of a fiduciary from managing tangible property to include management of a person’s digital assets. Under this act, fiduciaries can manage digital property like computer files, web domains, and virtual currency, but restricts a fiduciary’s access to communications such as email, text messages, and social media accounts unless the original user explicitly consented in a will, trust, or power of attorney.

RUFADAA Framework

Luckily, The Act provides a clear path as to how a person’s digital assets should be treated in the event a fiduciary seeks access from a service provider.

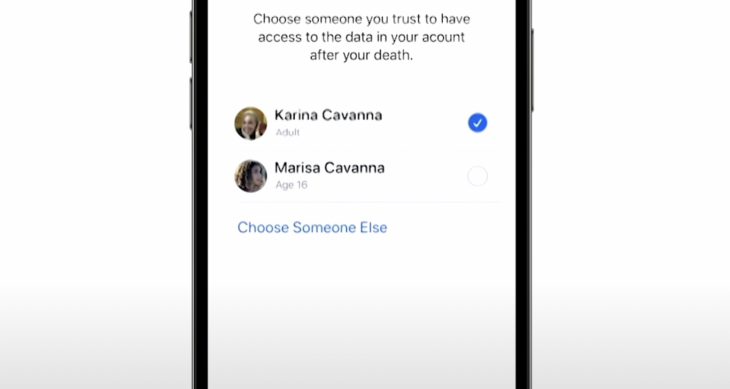

Online tool

Some tech companies have created online tools separate from their terms of service, which users can determine the extent to which their digital assets are revealed to third parties. Companies that have created these tools include Facebook Legacy Contact and the Google Inactive Account Manager. Under RUFADAA, If a user has provided directions through the online tool, it will supersede conflicting directives, including those in a will.

Will, trust, or power of attorney:

Second to the online tool is a Will, trust, or power of attorney: The user can authorize access to his or her assets after death through a will or trust and, during his or her lifetime, through a power of attorney. ²

Terms of service:

If the user has not provided direction for their digital estate, the custodian’s terms of service apply. The challenge is that the vast majority of people still do not read the lengthy TOS before clicking, “Accept,” and that many custodians’ Terms of Service are written in a manner that minimizes their responsibility after the primary user dies. This can be especially damaging as some custodian’s terms of service explicitly state that the user’s contents will be discarded upon death.

The deletion of a user’s account can result in a number of complications. Financially speaking, most people pay their bills almost completely online. Knowing what a decedent’s outstanding bills are is a critical piece of information for an executor who is in charge of settling the deceased outstanding debts. In today’s digital age, it’s not hard to imagine that there is no physical record of these expenses. The end result can be cumulative fees while your next of kin sorts out this hassle during what is an already stressful time. Additionally, sentimental assets may also be lost if there is not a plan in place. A lifetime’s worth of pictures, for instance, may be stored in a cloud service, or similar provider, and suddenly be permanently lost when the account is deleted. Contact lists of friends, family could be gone forever.

RUFADAA default rules:

If the terms of service do not cover the issue, RUFADAA’s default rules apply. Those default rules recognize multiple types of digital assets. For certain digital assets, like virtual currency, RUFADAA gives fiduciaries unrestricted access. For electronic communications, however, the statute does not provide fiduciaries access; instead, it allows them to access a log of the communications such as the addresses of the sender and recipient, as well as the date and the time the message was received.

What can I do?

Organize your Digital Estate and Passwords

Easeenet is an online digital estate organization tool and a password manager combined! Easeenet acts as your comprehensive Digital Estate Planning tool. We offer secure storage and simple, easy-to-use vaults for all of your documents, photos, and more. Our password manager is a vital tool in your digital estate planning, and we also have a browser extension Enjoy a user-friendly dashboard with one-click access to all websites, directly to the login page, and login credentials auto-filled for you. Best of all, everything updates seamlessly as you navigate the internet!

Designate a Legacy Contact and Digital Executor

Legacy contacts are users that you can assign to be able to see your vaults and stored documents in case of illness or death. You can invite legacy contacts by entering their email in your Easeenet account.

Keep in mind that you also need to grant your legacy contact authority access and control to your accounts in your will. Easeenet strongly encourages our users to select their digital executor as their Legacy Contact, but it’s up to you who you choose.

Provide Access Instructions

With Easeenet’s Legacy Contact and Legacy Worksheet, you can make sure that your current accounts and access instructions are captured for whoever is taking over. Once you have designated your Legacy Contact Decide who gets access to your Easeenet account by selecting Legacy Contacts Add your critical life details in your Legacy Worksheet.

You select which important people in your life are able to access your Easeenet vaults, documents, and legacy worksheet, and when, giving both you and your family peace of mind.

Complete your Legacy Worksheet

With your Easeenet account, you also have a legacy worksheet, This online form ensures you’ve captured the important information your loved ones need, far beyond online accounts. From medications, you take to where the safety deposit box key is, these critical details are securely available whenever and wherever needed.

Get started with a free 14-day trial today!